What is our financial position?

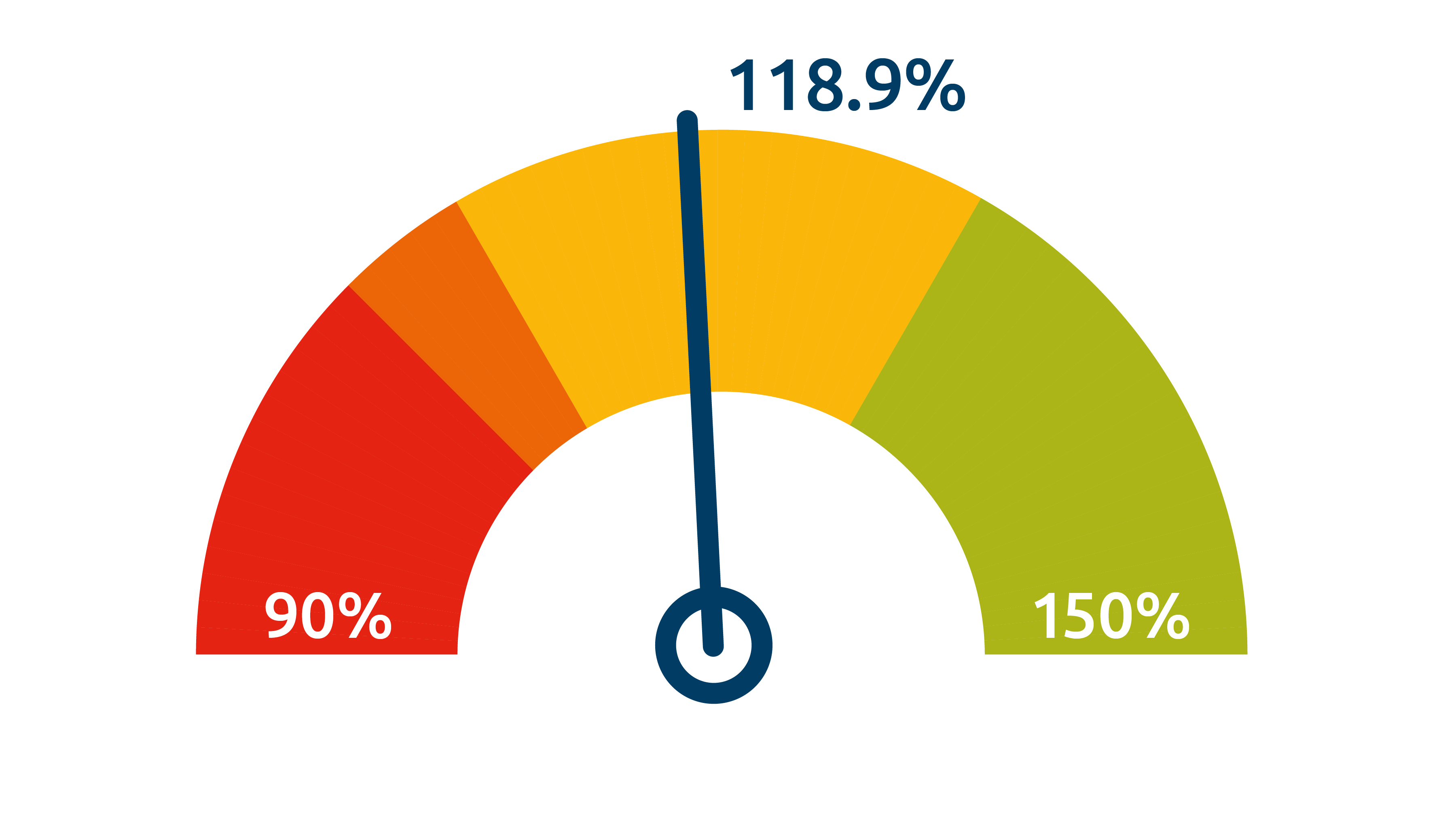

At the end of February 2025, our policy funding ratio was 118.9%. The policy coverage ratio decreased from January. The market interest coverage ratio increased to 117.9%. The required capital is 112.8%.

What does this mean for my pension?

To ensure that Nedlloyd Pension Fund can pay pensions - both now and later - Nedlloyd Pension Fund's coverage ratio must meet certain rules. First, of course, Nedlloyd Pension Fund wants to have a reserve. Therefore, a coverage ratio of 100% is not sufficient. The coverage ratio must be at least 104.1%, because a minimum required equity is necessary. There is a additional required equity. For Nedlloyd Pension Fund this is 115.0%.

If the financial situation of pension funds is not sufficient, a pension fund must make a recovery plan. The recovery plan contains measures to ensure that a pension fund returns to financial health. For example, by not increasing pensions. Or in extreme cases even reducing the pensions!

Funding ratio

We show the ratio of pension assets to pension liabilities in a percentage. We call this percentage the coverage ratio.

Overview funding ratioFrequently asked questions

The amount of your pension can still change. For example, by increasing (indexation) or decreasing (reduction) it. Whether your pension is increased or decreased depends on the financial position of the pension fund. If the financial situation does not meet the requirements for a longer period, the chance of indexation becomes small and the chance of reduction increases.

In the calculations in the recovery plan, assumptions are made. For example, for the development of interest rates and returns. During the course of the year, actual developments may differ from these assumptions. That is why the fund must draw up an updated recovery plan every year.

A pension fund must have buffers because the future is uncertain. This is how we ensure that we can pay everyone a pension even in the event of financial setbacks.